Forex CFD brokers

Forex CFD brokers offer an alternative to traditional forex trading, allowing traders to speculate on the price of various currency pairs without actually owning the underlying currencies. In this article, we’ll explore the world of forex CFD brokers, discuss their role, the benefits and drawbacks of trading forex CFDs, the associated risks, and other relevant information.

What is a Forex CFD Broker?

A forex CFD (Contract for Difference) broker is a financial services provider that allows traders to speculate on the price of currency pairs without owning the underlying currencies. CFDs are derivative instruments that track the price of an asset, such as a currency pair, and allow traders to profit from price movements without taking physical possession of the asset. Traders can open long or short positions, potentially profiting from both rising and falling markets.

Benefits of Trading Forex CFDs

No Need to Own Currencies

One of the main benefits of trading forex CFDs is that traders don’t need to own or store the underlying currencies. This eliminates the need for a traditional forex trading account, reduces the risk of currency ownership, and simplifies the trading process.

Leverage

Forex CFD brokers often provide leverage, enabling traders to control larger positions with a smaller initial investment. This can amplify potential profits (or losses) and allow for more efficient use of trading capital.

Trading Flexibility

Forex CFDs offer flexibility in trading, allowing traders to open long or short positions and potentially profit from both rising and falling markets. This is particularly advantageous during periods of market volatility, as traders can capitalize on price fluctuations in either direction.

Access to a Wide Range of Currency Pairs

Forex CFD brokers typically provide access to a wide range of currency pairs, including major, minor, and exotic pairs. This can enable traders to diversify their portfolios and gain exposure to different currencies and market drivers.

Drawbacks of Trading Forex CFDs

No Ownership of the Underlying Asset

When trading forex CFDs, traders do not own the underlying asset, meaning they cannot benefit from certain aspects of currency ownership, such as taking physical delivery or using the currency for international transactions. This limits the utility of forex CFDs for those who view currencies as long-term investments or means of hedging physical positions.

Risk of Counterparty Default

Forex CFDs involve an inherent counterparty risk, as the trader’s profits or losses depend on the solvency of the CFD broker. If the broker encounters financial difficulties or becomes insolvent, the trader may not receive their profits or be able to withdraw their funds.

Financing Costs

Trading forex CFDs on margin typically involves financing costs, which are charged by the broker for providing leverage. These costs can accumulate over time, especially for traders who hold positions open for extended periods, potentially eroding profits or exacerbating losses.

Higher Risk of Forex CFDs

Trading forex CFDs carries a higher level of risk due to several factors, including:

Leverage

While leverage can amplify potential profits, it also magnifies potential losses. Traders using high leverage can quickly lose a significant portion of their trading capital or even face account liquidation if the market moves against them.

Market Volatility

Forex markets can experience periods of volatility, which can lead to rapid and significant price fluctuations. This can make it challenging for traders to manage their risk effectively, as even small market movements can result in substantial gains or losses when trading with leverage.

Limited Regulatory Oversight

The forex CFD market may not have the same level of regulatory oversight as traditional forex markets. This can expose traders to a higher risk of fraud, market manipulation, or other unfair trading practices. It is essential for traders to conduct thorough due diligence when choosing a forex CFD broker, as not all brokers operate with the same degree of transparency and accountability.

Choosing a Reputable Forex CFD Broker

To minimize the risks associated with trading forex CFDs, it’s crucial to select a reputable and regulated broker. Consider the following factors when choosing a forex CFD broker:

Regulation and Licensing

Ensure the broker is regulated by a reputable financial authority, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) in Australia. Regulated brokers are required to adhere to strict financial standards and provide a higher level of transparency and accountability.

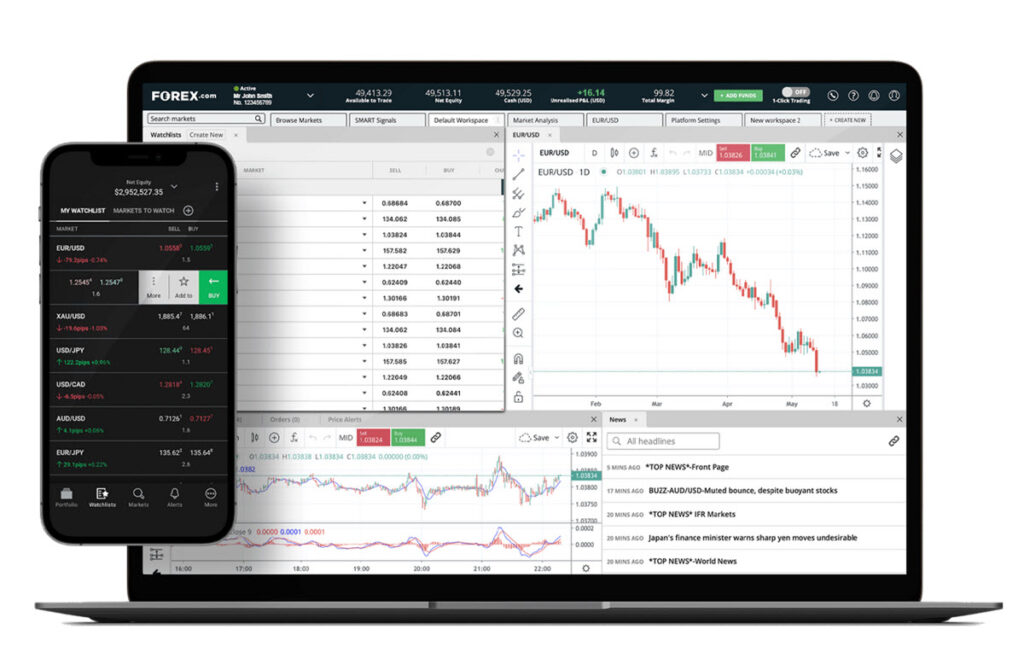

Trading Platform

Evaluate the broker’s trading platform for ease of use, reliability, and available features. Many forex CFD brokers offer popular platforms like MetaTrader 4 or MetaTrader 5, which are widely used and offer a range of advanced tools and features.

Customer Support

Quality customer support is essential when trading forex CFDs, as traders may require assistance with technical issues or account-related queries. Assess the broker’s customer support for responsiveness, availability, and knowledgeability.

Trading Costs

Consider the trading costs associated with the broker, including spreads, commissions, and financing charges. These costs can have a significant impact on a trader’s profitability, especially for those who trade frequently or hold positions open for extended periods.

Conclusion

Forex CFD brokers offer an alternative to traditional forex trading, allowing traders to speculate on the price of various currency pairs without owning the underlying currencies. While trading forex CFDs can provide several benefits, such as leverage and trading flexibility, it also carries inherent risks, including amplified losses, counterparty risk, and limited regulatory oversight.

By carefully considering the advantages and drawbacks of trading forex CFDs and conducting thorough research to select a reputable and regulated broker, traders can potentially capitalize on the opportunities presented by the forex market while minimizing the associated risks.